Mobile & Internet

Xiaomi takes 2nd spot after Samsung in August smartphone sales

|

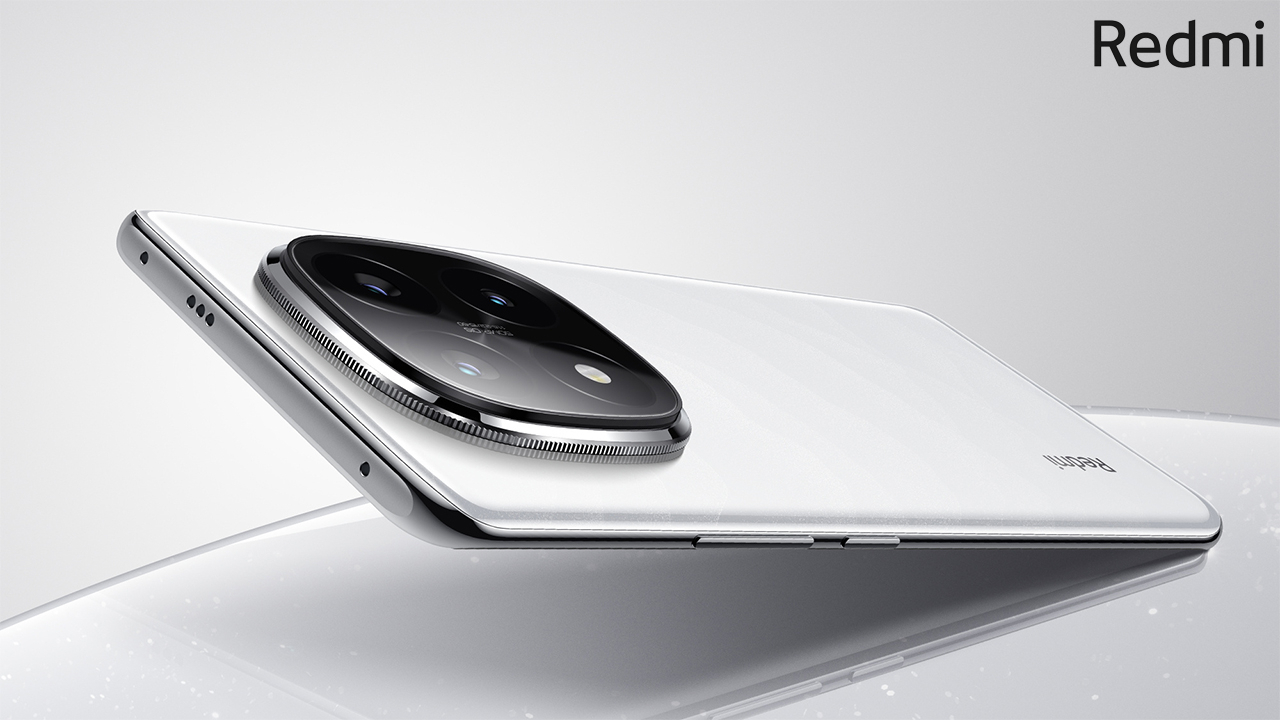

Redmi Note 14 Pro (Xiaomi) |

Chinese smartphone makers are swiftly growing their presence in the global market, taking over the entry-to-mid-tier segment while creating a buzz with unique premium models to narrow the competitive gap with top players Samsung and Apple.

In August, Chinese firm Xiaomi claimed second in terms of global monthly sell-through volumes for the first time in three years, beating Apple, market tracker Counterpoint Research said Thursday. Samsung Electronics retained the top spot.

August is usually seen as Apple's weakest month in a year, given how the company usually launches its new-generation iPhones in October. Xiaomi appears to have benefited from Apple’s seasonal slide for the month.

But as one of the fastest-growing brands in the first half of this year marking 22 percent on-year growth in sales volume, Xiaomi’s beating of Apple is “symbolic” according to the market tracker.

“Xiaomi capturing the No. 2 spot is symbolic of a more significant trend in the global smartphone market. As devices edge closer to each other in terms of technology and price, competition has never been higher among the top brands,” the market tracker said in its analysis.

“With new form factors (foldables) and generative AI features helping brands differentiate their offerings, device ecosystem, product design, and marketing strategy and research remain as important as ever, as evidenced by Xiaomi’s recent surge.”

The company, having suffered from severe supply struggles in 2022, has adopted a “leaner product strategy” to create one hero model per price band while tapping into new markets and consolidating its positions in existing markets, Tarun Pathak, research director at Counterpoint Research, said.

As Samsung and Apple vie for dominance with premium flagship smartphones and introducing generative AI models, Xiaomi and other Chinese brands like Huawei are rapidly closing the gap with the top smartphone makers.

In the foldable segment, Huawei is aggressively chasing after Samsung, the foldable smartphone pioneer. In the second quarter this year, Huawei took a 27.5 percent share in the global market, beating Samsung, which posted 16.4 percent.

Amid the rising competition, Samsung is expanding its Galaxy AI features for older and budget smartphone lines.

As Apple launched its latest iPhone 16 series Friday with disappointing preorders, the roll-out of Huawei’s Mate XT tri-fold smartphone sparked frenzy the same day. As of Wednesday afternoon, the tri-fold smartphone, with a price tag starting at $2,800, generated more than 6.3 million reservations on the company’s Vmall e-commerce platform.

Apple’s iPhone 16 lineup sold 37 million units, down around 12.7 percent when compared to the iPhone 15 lineup's first weekend of sales, said Ming-Chi Kuo, a supply chain analyst at TF International Securities.

Huawei’s advancement in foldable smartphones is backed mainly by demand from the Chinese market. According to the market tracker, foldable smartphone sales in China in the second quarter jumped 102 percent on-year, and Huawei took 42 percent of the sales volume.

By Jo He-rim (herim@heraldcorp.com)

![[From the Scene] Gigantic Olive Young store lures young trend-setters in Seongsu](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/11/21/20241121050065_0.jpg)