Bio

KRX decides to delist troubled Kolon TissueGene

The Korea Exchange, South Korea’s stock market operator, on Aug. 26 announced its decision to delist troubled Kolon Group’s US gene therapy-developing unit Kolon TissueGene.

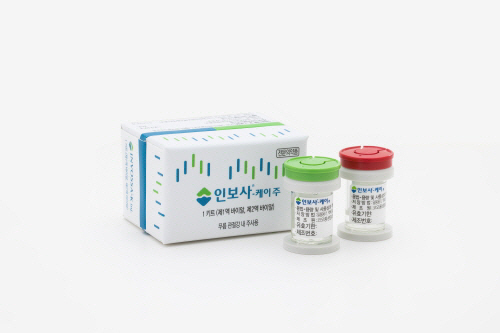

In late March, a component of Kolon TissueGene’s gene therapy drug Invossa -- labeled as “a gene-containing chondrocyte” since 2004 -- was found to include a kidney cell and this should have been labeled accordingly.

|

The group has spent more than 19 years developing this drug, an intra-articular injection that offers a nonsurgical treatment option for treating knee osteoarthritis.

The recent decision was made after KRX reviewed the extent to which the issue related to Invossa has affected its investors.

According to Kolon TissueGene’s 2018 annual report, a 36.7 percent stake in the company is owned by minority shareholders. The value of this stake shrank from 778 billion won ($641.36 million) in March to around 180.9 billion won in May, when the company’s stock was suspended of trading.

KRX also did not accept the Korean company’s explanation that it did not intentionally mislabel the component and is still confident about Invossa’s effectiveness and safety.

Industry sources say the delisting might affect another bio affiliate of the group, Kolon Life Science, as it owns a 12.57 percent stake in Kolon TissueGene.

Despite the KRX’s decision, the delisting process is expected to take a while. Within 15 business days, the Kosdaq Listing Maintenance Review Committee will have to once again determine whether to remove Kolon TissueGene from the secondary board Kosdaq.

Even after the committee finalizes its decision, the Korean company has a chance to appeal. In this case, it may take around two years for the delisting of Kolon TissueGene.

By Song Seung-hyun (ssh@heraldcorp.com)