Samsung

Competition heats up in HBM market as Nvidia endorses Samsung chip

|

(Yonhap) |

The race for leadership in the burgeoning high bandwidth memory chips market is growing fiercer, as Nvidia revealed its plan to secure orders for the cutting-edge component from Samsung Electronics, the Korean chip giant seeking to outsmart crosstown rival SK hynix.

At a media briefing last week, Jensen Huang, the co-founder and CEO of Nvidia, openly endorsed Samsung Electronics and unveiled the company's plan to use the Korean chipmaker's HBM chips in the future. US-based Nvidia is the biggest buyer of advanced HBM chips, which have become a key component for artificial intelligence graphics processing units.

"HBM memory is very complicated and the value added is very high. We are spending a lot of money on HBM," Huang said at a media briefing held as part of the company's annual GPU technology conference Tuesday in San Jose, California.

"I am not using Samsung's HBM3E yet. I am currently verifying it," he added. "Samsung is very good, a very good company."

|

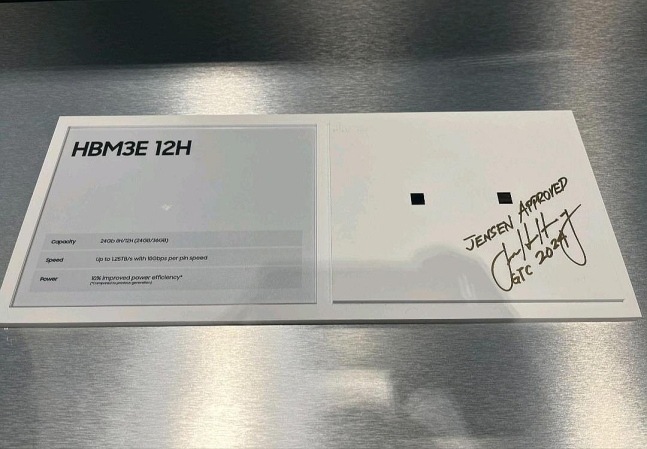

Nvidia CEO Jensen Huang’s written signature includes the phrase “Jensen approved,” next to Samsung’s 12-stack HBM3E prototype displayed at the Samsung Electronics showroom at the GTC 2024 technology conference in San Jose, California. (Captured from Samsung Electronics Executive Vice President Han Jin-man's social media) |

Huang was also seen visiting Samsung's showroom set up at the GTC event. There he left a short comment of "Jensen approved" on the side of Samsung's 12-stack HBM3E, raising speculations that Nvidia is carrying out qualification tests on the latest model. The Nvidia chief did not visit SK hynix's booth.

Over Huang's open endorsement of Samsung, industry officials explained Nvidia would likely want to take a multivendor strategy to reduce the risks of having just one supplier.

“In the buyer’s perspective, having only one supplier for a key component in their product would feel unsafe. They would want to work with multiple vendors to secure higher leverage in purchase deals,” an industry official explained under condition of anonymity.

"(The Nvidia CEO's) mention of Samsung could be interpreted differently, since it means Samsung's product has not yet passed the qualification tests."

When new memory chips are developed, they go through a qualifying test process to verify their compatibility with the client's product. When a chip is qualified, it means it is ready to start mass production.

HBM chips have come into the spotlight as a novel technology, stacking DRAM chips vertically to increase data processing speed. HBM3 is currently widely used, but chipmakers are introducing the extended version, HBM3E.

SK hynix is expected to be the first supplier to deliver eight-stack HBM3E to Nvidia, as it announced that it has started mass production and plans to supply the advanced chips to Nvidia by the end of this month.

|

Nvidia CEO Jensen Huang delivers a keynote address during the Nvidia GTC Artificial Intelligence Conference at SAP Center on March 18, 2024 in San Jose, California. (AFP-Yonhap) |

In order to secure an edge, Samsung announced it has developed 12-stack HBM3E, with the industry’s largest capacity of 36 gigabytes, and said it plans to start volume production in the first half of this year. The chip giant also confirmed it is in preparation of mass producing the eight-stack HBM3E by around June and July.

Micron Technology also said it will start mass production of HBM3E and deliver the products to Nvidia within the first half of this year.

While HBM chips currently account for only about 1 percent of the total memory chip market in terms of revenue, it is expected to quickly expand its presence in the wake of the generative AI boom.

"With the generative AI, DDR RAMs in all data centers will be replaced by HBMs, and the upgrade cycle of Samsung and SK hynix will be huge," Huang added.

SK hynix is the current leader in the HBM market, securing about 53 percent of market volume, while Samsung takes about 38 percent, according to TrendForce, a market tracker. US-based Micron Technology accounts for the remaining 9 percent share.

At the regular shareholders meeting on Wednesday, Samsung President Kyung Kye-hyun, in charge of the company's chips division, said, "This year will be a year of full recovery and growth (for Samsung)."

"We will take back the No. 1 position in the global chip industry in the next two to three years," he added, specifying that the company will start mass production of the 12-stack HBM3E chip in the first half of this year.

By Jo He-rim (herim@heraldcorp.com)

The Korea Herald