Market Now

With conservative leader taking office, big 4 chaebol groups ready to spend big

|

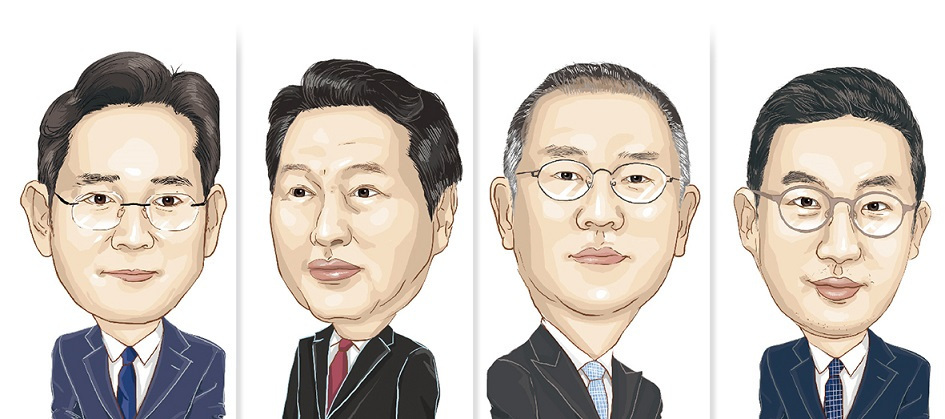

From left are Samsung Electronics Vice Chairman Lee Jae-yong, SK Group Chairman Chey Tae-won, Hyundai Motor Group Chairman Chung Euisun and LG Group Chairman Koo Kwang-mo. (Illustration by Park Ji-young) |

In his inauguration speech on Tuesday, President Yoon Suk-yeol reaffirmed his will to seek a small government and to push for growth and a market economy. And South Korea’s top four chaebol groups -- Samsung, SK, Hyundai Motor and LG -- seem ready to fuel momentum.

During his presidential campaign, Yoon vowed to create a business-friendly environment by lifting red tape and offering full support across industries.

He especially stressed “super gap” technologies in the burgeoning fields of semiconductors, batteries and artificial intelligence, where Korean companies are top players but face increasing challenges in global markets.

With expectations running high for the new government’s hefty incentive package for the tech industry, the nation’s four largest conglomerates are highly likely to respond with big investment plans.

Samsung, the largest, is expected to play a leading role both in spending and jobs.

Its crown jewel Samsung Electronics, abundant in cash, announced a three-year investment plan worth 240 trillion won ($187 billion) in August last year but no major investment has been made other than a $1.7 billion foundry plant in Taylor, Texas, unveiled in November.

Even though its leader, Vice Chairman Lee Jae-yong, faces work restrictions following his prison years on corruption charges, his role will be crucial in speeding up Yoon’s push on chips, which has become a national security issue amid global supply chain disruptions.

Speculation is growing that US President Joe Biden is considering making a visit to Samsung’s chip complex in Pyeongtaek, Gyeonggi Province, during his planned three-day visit to Seoul on May 20-22.

It is also likely for Lee to head to the US next month to attend the groundbreaking ceremony of the new Taylor plant. Along with the Pyeongtaek complex at home, the US plant is expected to become a new major chip base for Samsung.

Samsung, the world’s largest memory chipmaker, has pledged to widen gaps with its memory rivals, while aiming to become a market leader in more advanced logic chips by 2030.

Other than chips, Samsung has cited robots, artificial intelligence, 6G, biopharmaceutical, and metaverse as the key growth drivers, hinting at potential mergers and acquisitions.

SK Group, which recently became the second-largest conglomerate in terms of asset value for the first time in 16 years, is also expected to pour resources into chip, battery and bio sectors.

SK hynix, the world’s No. 2 memory chipmaker, has invested a combined 46 trillion won over the past 10 years since it was acquired by SK Group. The firm plans to invest an additional 120 trillion won into its four plants in Yongin, Gyeonggi Province.

SK On, its fast-growing battery-making unit, is spending aggressively to beef up its production of batteries for electric vehicles around the world, with an aim to elevate the capacity to 220 gigawatt-hours by 2025.

Hyundai Motor Group is expected to speed up its hydrogen push under the new government’s drive to cut emissions.

The auto giant aims to replace its new car lineup with EVs and hydrogen-powered vehicles in Europe by 2035. At home, the target year is 2040.

In order to achieve the ambitious goal of selling 1.87 million EVs globally, Hyundai plans to inject 95.9 trillion won by 2030.

Its futuristic businesses such as urban air mobility and robotics are likely to gain momentum as the new government has promised to increase incentives in those fields.

Hyundai is finalizing talks on the location of a new EV plant in the US. A news report earlier in the day said it could be in Georgia, while the carmaker said nothing has been decided yet.

In recent years, LG Group has focused resources into automotive parts and EV batteries as new growth drivers.

LG Electronics produces key components and solutions ranging from in-car infotainment system to processor chips. Its rumored partnership with Apple on the Apple Car project, if proven true, is also expected to offer a boon for business expansion.

LG Energy Solution, the group’s EV battery unit that made a blockbuster stock debut earlier this year, is also making huge investments to secure a production capacity of at least 447 gigawatt-hours by 2025. In this year alone, the firm has earmarked 7 trillion won for expanding production network around the world.

“Basically, large-scale investments will be led by individual companies. They are pinning high hopes on eased regulations and diverse tax cuts,” said an industry official on condition of anonymity.

“The big four groups usually play a leading role in announcing major investment plans to add momentum to a new government.”

By Lee Ji-yoon (jylee@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/11/25/20241125050044_0.jpg)