Finance

Korea launches robo investing apps for 1st time

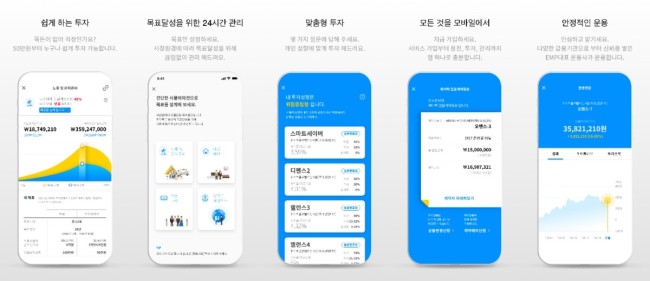

South Korea launched its mobile robo investing apps for the first time on April 17. They not only provide financial advice, but also manage customer’s investments without human intervention.

|

Courtesy of Quarterback Investments |

The apps debuted on the Android platform through a joint effort by brokerage firm KB Securities and asset management firms December & Company and Quarterback Investments. It will be available on the Apple App Store in May.

The artificial intelligence technology realigns a portfolio of assets composed of exchange-traded fundsand public equity funds on a daily basis.

The algorithm for "Fint" is powered by December & Co. software ISAAC, while "Quarterback" by Quarterback Investments are powered by algorithm software QBIS. Users of the apps will open an account through KB Securities. The brokerage has laid the groundwork for product development by providing them with open-API.

Prior to Fint and Quarterback, Korean robo-advisor apps were limited to giving algorithm-based digital investment advice to users.

From March, a minimum capital threshold for operators of robo-investing app has been drastically lowered to 1.5 billion won ($1.3 million). Previously, the threshold stood at 4 billion won.

The Korean fintech industry has welcomed the launch.

"The robo advisor app development has lagged behind other fintech sectors, but robo advisor services have the potential to take a leap forward,” Korean Fintech Industry Association President Joey Kim said in a statement.

By Son Ji-hyoung (consnow@heraldcorp.com)