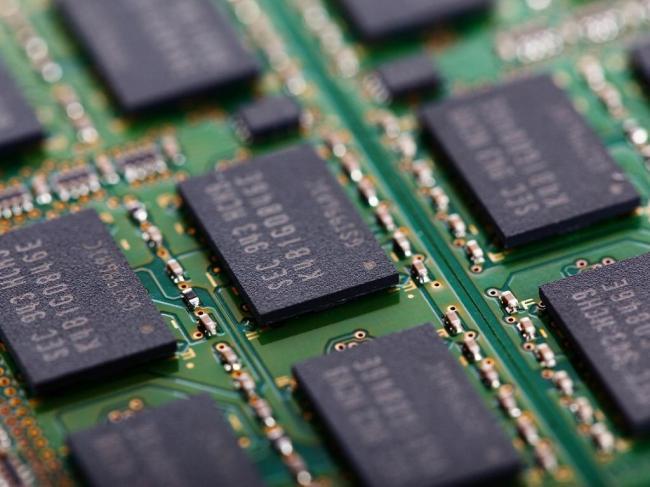

Samsung

Falling DRAM prices may hit Samsung hard in Q1: analysts

As the DRAM market downturn lingered on in the first three months of this year, Samsung Electronics -- the biggest DRAM maker by sales -- will likely see its profits drop significantly during the period, according to market analysts on March 7.

The latest analysis of the PC DRAM market by market research firm DRAMeXchange showed that prices dropped nearly 30 percent in the first quarter, higher than the originally predicted 25 percent. This is the sharpest quarterly decline since 2011, according to the research firm.

|

Due to the highly volatile prices in recent months, large DRAM customers, such as data server operators, tend to sign monthly contracts with DRAM suppliers rather than every quarter.

As if adding fuel to fire, inventory levels have also built up while demand has been sluggish.

As a result, local brokerages have adjusted their previous estimates for Samsung’s first-quarter earnings.

Early this year, they forecast that the tech giant would post an operating profit of 14 trillion won in the first quarter, but they have cut their estimates, by up to some 50 percent, to around 8 trillion won.

“The tech firm’s first-quarter operating profit will likely stand at 8 trillion won -- 5 trillion won from the chip business, 2.7 trillion won from the mobile business, and the remaining from others,” said Kim Dong-won, an analyst at brokerage KB Securities, citing the prolonged price decline of both DRAM and NAND flash memory chips as the biggest reason behind the profit drop.

The estimated operating income is 56.9 percent lower than the one posted during the same period last year, while for the mobile business it is down 28.9 percent on-year.

Some market analysts also forecast the recent DRAM market downturn will change the market landscape as smaller and less competitive players will be weeded out, while larger ones will be able to take a bigger market share after the downturn season.

By Kim Young-won (wone0102@heraldcorp.com)