Industrials

Five conglomerates resolve cross-shareholding structure

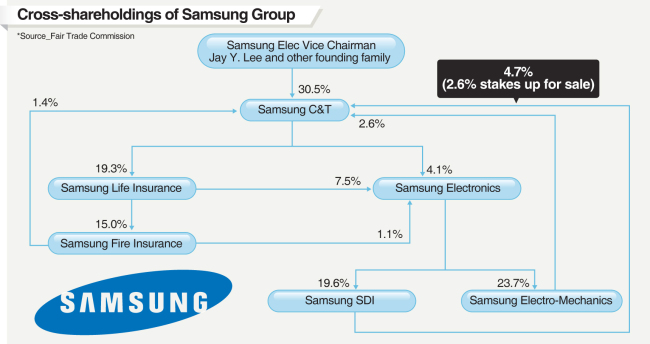

[THE INVESTOR] Samsung Group and four other major conglomerates have completely ended their circular cross-shareholding structures, Korea’s antitrust watchdog said on Dec. 28.

The four other big business groups are retail giant Lotte, Hyundai Heavy Industries Group, Daelim Group and Hyundai Department Store Group, the Fair Trade Commission said.

|

The latest move comes as Korea has been pressing conglomerates to unwind their cross-shareholding ties among affiliates as part of efforts to improve their governance structure and boost transparency.

Critics claim cross-shareholding arrangements are largely meant to strengthen family control over numerous affiliates and the group as a whole.

In March, a slew of large conglomerates, including Hyundai Motor Group, unveiled plans to streamline their ownership structures through business spinoffs and mergers among affiliates.

In April, FTC Chairman Kim Sang-jo cited Hyundai Motor’s case as “the most desirable” one for local conglomerates that are required to restructure their circular cross-shareholding structures.

But the world’s fifth-largest carmaker by sales withdrew its key spin-off merger plan in May due to opposition campaigns by global hedge fund Elliott and proxy advisers such as Institutional Shareholder Services.

By Song Seung-hyun and newswires (ssh@heraldcorp.com)