Economy

Korea seeks to expand free trade networks

[THE INVESTOR] South Korea needs a balanced and sophisticated strategy to cope with efforts by China and Japan to take the lead in building a free trade framework for Asia and the Pacific amid the US’ strengthening protectionism, experts here say.

At a summit in Manila earlier this month, the leaders of 16 countries involved in talks on launching the China-led Regional Comprehensive Economic Partnership agreed to complete the negotiating process by the end of 2018.

|

RCEP encompasses the 10-member Association of Southeast Asian Nations, China, Japan, Korea, India, Australia and New Zealand. Combined, they account for nearly half of the world’s population and almost one-third of global trade and gross domestic product.

Three days before the RCEP summit, Japan and 10 other countries around the Pacific Rim affirmed their commitment to reviving the Trans-Pacific Partnership without the US.

At a meeting on Nov. 11 in Danang, Vietnam, the countries’ ministers agreed on the core elements of a deal to take the place of the TPP, which Donald Trump rejected shortly after he was sworn in as US president early this year.

The new deal named the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership is planned to be finalized by the first quarter of 2018.

While taking some rules from the original accord, the CPTPP looks quite similar to its predecessor. Japan has been eager to create incentives for the US to join the pact in the future.

Korea was not included among the 12 countries that concluded the TPP in October 2015.

Then-US President Barack Obama, backed by Japanese Prime Minister Shinzo Abe, had pushed for the conclusion of the deal excluding China, which he said should not be allowed to write the 21st-century international trade norms while it has unfair practices in place.

At the time, Korea focused on reaching a bilateral free trade agreement with China, hesitating to join the TPP, which was denounced by China as a scheme designed to keep in check its growing economic power.

The move by Japan and 10 other Pacific Rim countries to fix the accord deserted by Trump suggests the US’ absence would not eliminate the benefits of the deal.

Choi Byung-il, a professor of the Graduate School of International Studies at Ewha Womans University, described the TPP without the US as a “strategic space open for Korea.”

Experts say Korea needs to move to join the TPP 11 and set aside concerns about possible disadvantages that may be caused in trade with Japan. The 10 other members are Australia, Brunei, Canada, Chile, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam.

Korea also stands to gain from the early conclusion of the 16-member RCEP deal.

Since May 2013, 20 rounds of negotiations have been held to conclude the trade accord, which made little progress due to differences among the countries involved over the degree of market liberalization.

Korea has sided with Japan and Australia to call for eliminating or reducing tariffs on about 90 percent of goods traded in the region, while China, India and most Southeast Asian nations want a lower-level deal.

Some experts note wider market access guaranteed under the RCEP scheme could help lift China’s trade barriers and keep it from resorting to bullying tactics in disputes with other countries.

Korea is also positioned to play a bridging and catalytic role between China and Japan in reaching a trilateral free trade deal, which could result in facilitating the broader economic integration of the Asia-Pacific region.

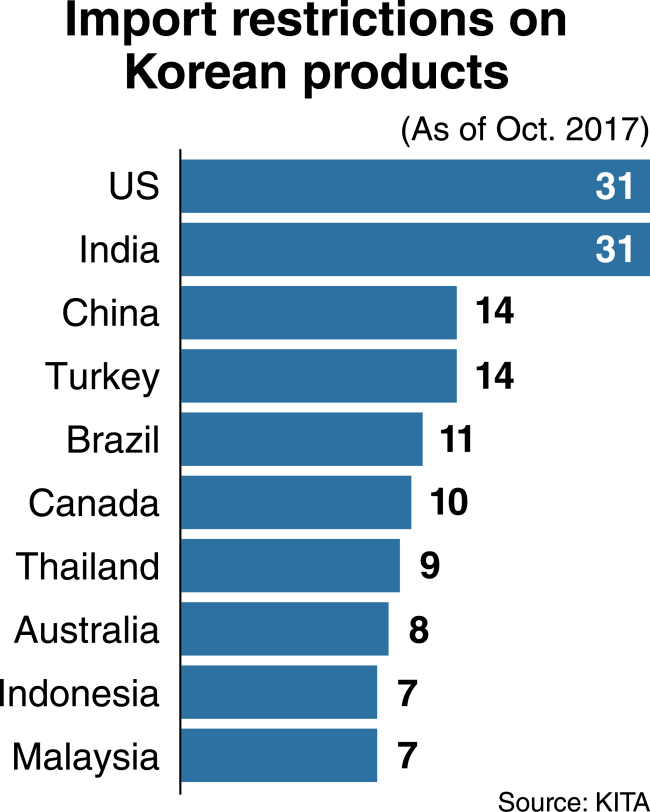

Efforts toward expanding multilateral trade networks have taken on added significance as Korea has in recent years seen import restrictions on its products increase across the globe and its export growth fall behind a rise in world trade.

According to data from the Korea International Trade Association, the country’s companies faced 31 import restrictions on their goods in the US and India as of October, followed by 14 in China and Turkey, 11 in Brazil and 10 in Canada.

The Bank of Korea recently forecast Korea’s outbound shipments would increase 3.7 percent and 3.5 percent from a year earlier in 2017 and 2018, respectively. The increase rates fall below the 4.2 percent and 4 percent gains in global trade in the corresponding years, as projected by the International Monetary Fund earlier this year.

Korea’s exports have underperformed international trade since 2014. During the period between 1980 and 2013, the country’s outbound shipments grew at a slower pace than global commerce only four times -- in 1985, 1989, 1990 and 2001.

“Over the past years, there has been little increase in global demand for Korea’s major export items except for semiconductors,” said Lee Geun-tae, an analyst at the LG Economic Research Institute.

Experts say Korea should redouble efforts to forge free trade deals with more regional blocs to overcome rising protectionism.

The country’s negotiators hope to launch free trade talks with the Russia-led Eurasian Economic Union (EAEU) by the end of the year.

The combined GDP of the EAEU, which also includes Armenia, Belarus, Kazakhstan and Kyrgyzstan, amounted to $1.6 trillion last year, with its population totaling 180 million.

Korea also agreed with Uruguay during a bilateral economic committee meeting here last week to make a joint push for a trade accord between the country and Mercosur, a South American common market comprised of Argentina, Brazil and Paraguay as well as Uruguay.

Bilateral trade between the two sides has been on a downturn since peaking in 2013.

By Kim Kyung-ho/The Korea Herald (khkim@heraldcorp.com)