Bio

Samsung Bioepis wins patent invalidation case against AbbVie’s Humira

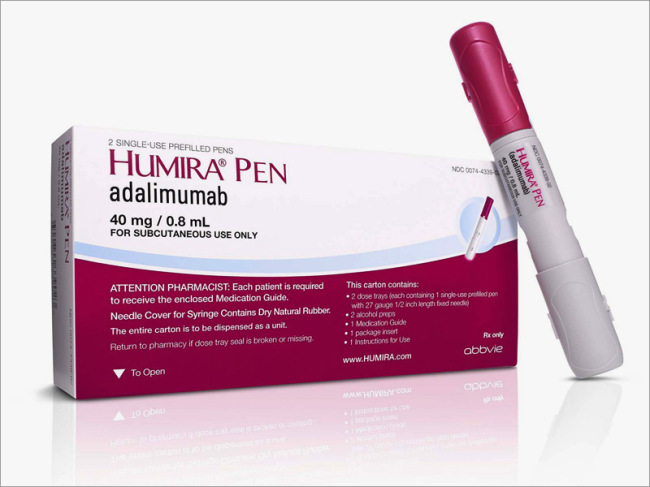

[THE INVESTOR] A UK court has determined that two patents covering AbbVie’s best-selling drug Humira are invalid, ruling in favor of Samsung Bioepis which hopes to sell a biosimilar version of the arthritis treatment in the European markets as early as next year.

The UK High Court of Justice ruled on March 3 in favor of the Samsung Group subsidiary and its partner Biogen, invalidating AbbVie’s two secondary patents for the arthritis medicine Humira, which expire in 2022 and 2023, respectively.

|

The ruling came a year after Bioepis filed the patent suit in respect of the validity of certain dosing regimens for rheumatoid arthritis, psoriasis and psoriatic arthritis in March 2016 to launch SB5, its biosimilar -- a highly similar and likely less expensive version -- in the lucrative markets sooner.

The UK court declared that “the dosing regimens were obvious and are therefore not eligible for patent protection.”

The composition patent for Humira will lose its exclusivity in Europe in October 2018 but the US drug maker filed the new patents in a bid to fend off competition from biosimilars. Humira accounts for almost two-thirds of AbbVie’s revenue.

Following the commencement of the legal proceedings, AbbVie abandoned the patents in the UK but Bioepis continued to move forward with its lawsuit.

“We welcome the court’s judgment. At Samsung Bioepis, we remain committed to driving positive change in the healthcare system through the development of affordable and high-quality biosimilars,” an official at Samsung Bioepis said.

Analysts here said the ruling would help move up the Europe release date of Humira biosimilars.

“If SB5 is successfully launched, the medication will have the highest potential among other candidates in the Bioepis’ pipeline due to strong prescription demand and patent barrier,” Dongbu Securities analyst Gu Ja-yong said.

SB5, an adalimumab biosimilar candidate referencing Humira, was accepted for review by the European Medicines Agency in July 2016.

Once SB5 gets a marketing authorization, it will become the Korean firm’s third biosimilar product that will hit the European markets, following Benepali, the first etanercept biosimilar referencing Enbrel approved in the EU, and Flixabi, a biosimilar of Johnson & Johnson’s Remicade.

The three tumor necrosis factor inhibitors -- Remicade, Humira and Enbrel -- are top selling drugs of any class with annual combined sales stood at 34 trillion won (US$29.42 billion) in 2015.

Bioepis isn’t the only company looking to grab a piece of the Humira pie. Big pharma firms including Amgen, Novartis and Merck have their own Humira biosimilars in development.

AbbVie, however, which has amassed more than 70 newer patents on Humira, covering formulations of the drug, manufacturing methods and use for specific diseases, is expected to continue to use the patent protection to keep the biosimilars off the market, Gu said.

By Park Han-na (hnpark@heraldcorp.com)