Mobile & Internet

More budget phones embrace fingerprint scanning

[THE INVESTOR] As many major smartphone makers are trying to adopt a different range of biometric sensing technologies, such as an iris scanner or a face scanner, to enhance mobile security, fingerprint readers seem to lose ground to stand in the smartphone market.

The fingerprint sensing technology, however, will further gain steam as it will be more widely adopted in mid- and low-end smartphones, according to industry sources.

|

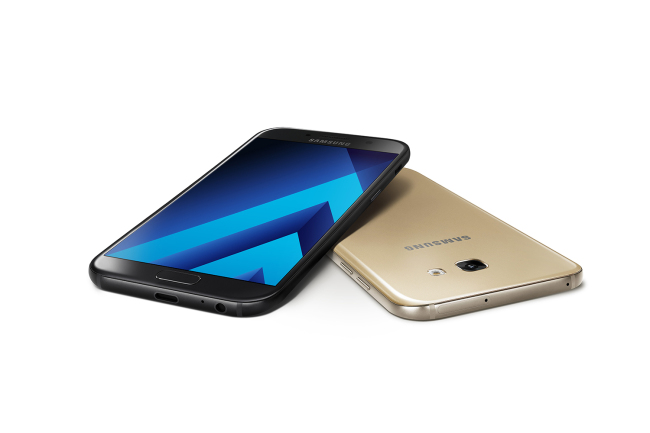

Samsung Galaxy A. The Korean tech giant hints at adopting fingerprint scanning to its cheapest Galaxy J smartphone later this year. |

The fingerprint sensor market, which reached US$630.6 million in size in 2016, will see the entire shipment volume of fingerprint sensors more than double from 500 million in 2015 to 1.6 billion in 2020, according to market research firm IHS Markit.

Device makers continue to roll out diverse fingerprint sensor-equipped smartphones, which is in line with their initiatives to expand mobile payment services. The sensing technology is needed to authenticate users in paying for mobile purchases.

As hinted by Samsung Electronics mobile division chief Koh Dong-jin last year, Samsung has deployed fingerprint readers for its budget smartphones, such as the Galaxy A and C series. The new low-end Galaxy J smartphones, scheduled to hit the shelves later this year, are also expected to come with a fingerprint scanner.

Samsung’s compatriot rival LG Electronics employed fingerprint sensors made by Goodix of China in its Stylus 3 and K10 smartphones.

For Chinese smartphone makers Huawei, OPPO, vivo, and Xiaomi, which move fast in adopting new technology, the fingerprint scanner has long been a mainstream smartphone feature.

“It seems nearly 50 percent of smartphones being sold in the Chinese market are installed with a fingerprint scanner,” said a market watcher, adding mobile payment services popular in the nation sped up the adoption of the biometric technology.

Chip makers have also been riding momentum created by the booming biometric sensor industry in recent years.

Notably, Korean chip-maker Dongbu HiTek, which suffered an operating loss for years a few years ago, has been fully operating its manufacturing lines dedicated to the production of fingerprint sensors thanks to the increasing orders from China.

It posted a record operating profit of 172.4 billion won (US$150 million) thanks to the robust chip businesses including the one for the fingerprint sensors.

By Kim Young-won (wone0102@heraldcorp.com)