Samsung

[SAMSUNG-HARMAN DEAL] ‘Harman on track to close Samsung deal’

[THE INVESTOR] Harman International has reaffirmed its intention to finish the planned integration with Samsung Electronics within the first half of this year, despite growing uncertainties surrounding the US$8 billion mega deal.

About the recent class action suit by some investors against the deal, the US audio giant downplayed the serious impact on the upcoming shareholders’ vote.

“Feedback regarding the transaction has been very positive, and this transaction will deliver compelling and immediate value to shareholders at a 37 percent all-cash premium,” a Harman executive told The Investor via email on Jan. 17.

“We are still on track for a mid-2017 close.”

|

Harman CEO Dinesh Paliwal |

Related:

Samsung to supply chips for Tesla’s self-driving cars

Samsung considers using Harman audio for Galaxy S phones from 2018

Samsung president reaffirms intention not to build cars

On Jan. 13, a group of Harman investors filed a suit in the US against the company’s CEO and board, saying the selling price was “unfairly cheap.” A shareholders’ vote is expected to be held in the first quarter.

Under the deal, Samsung will be paying US$112 per Harman share in cash, marking a 28 percent premium on the closing price Nov. 11, a day before the deal was publicized, and a 37 percent premium on its 30-day volume weighted average.

The investors, however, claimed Samsung’s buying price is still too low, considering the share price reached as high as US$145.10 in April 2015.

Earlier in December, US hedge fund Atlantic Investment Management, which owns a 2.3 percent stake in Harman, also said it would vote against the deal, citing the deal price.

Despite some resistance, the Samsung-Harman deal is widely considered a win-win for both companies.

Samsung, facing a high barrier of entry in the automotive industry, will include the world’s largest audio and infotainment systems supplier to a slew of global carmakers into its business portfolio, while Harman will expand its presence in the burgeoning connected car solutions market by teaming up with the Korean electronics and memory chip giant.

|

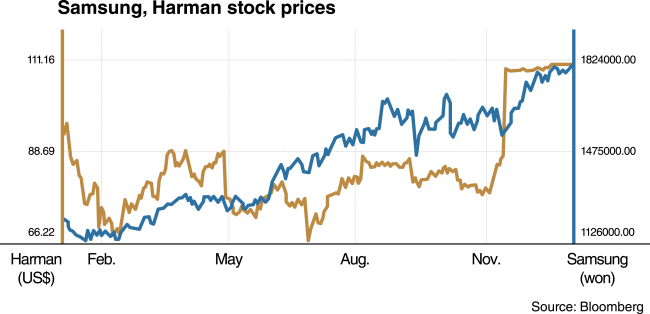

Since the merger deal was announced in November, Samsung and Harman stocks have soared over the past three months. |

Their stocks have also soared on the upbeat outlook. Harman alone saw an almost 30 percent jump over the past three months. On Jan. 16, the price closed at US$110.67 in the New York stock market.

“Harman CEO Dinesh Paliwal recently met the top 10 investors and they were reportedly happy with the more than 30 percent cash premium,” an industry source close to the matter said on condition of anonymity.

The source said it is also less likely that an arrest warrant for Samsung Electronics Vice Chairman Lee Jae-yong, who spearheaded the company’s largest-ever purchase, could affect the ongoing deal process.

“Samsung may feel a need for Lee and other executives to meet some Harman investors before the vote. But the Harman management seems to have already secured favorable votes from key investors,” he added.

The Harman executive declined to comment on the issue.

On Jan. 16, a special counsel team investigating the influence-peddling scandal involving President Park Geun-hye sought an arrest warrant for the Samsung heir on bribery charges. Samsung immediately denied that its financial support, worth a combined 44 billion won (US$37 million), for the president’s confidante was intended to receive business favors. Since the investigation started, Lee has been banned from traveling abroad.

With a Seoul court deciding on Lee’s arrest on Jan. 18, Samsung is making all-out efforts to minimize the possible impact on its ongoing merger and acquisition talks and other ongoing business projects.

After getting the shareholders’ final approval, Samsung and Harman plan to start the integration work. Like previous cases, all the management members of Harman are expected to remain even after the acquisition. About 8,000 software designers and engineers are working currently.

By Lee Ji-yoon (jylee@herladcorp.com)

![[From the Scene] Gigantic Olive Young store lures young trend-setters in Seongsu](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/11/21/20241121050065_0.jpg)