Industrials

After impeachment vote, companies shift to tackling Trump-era challenges

|

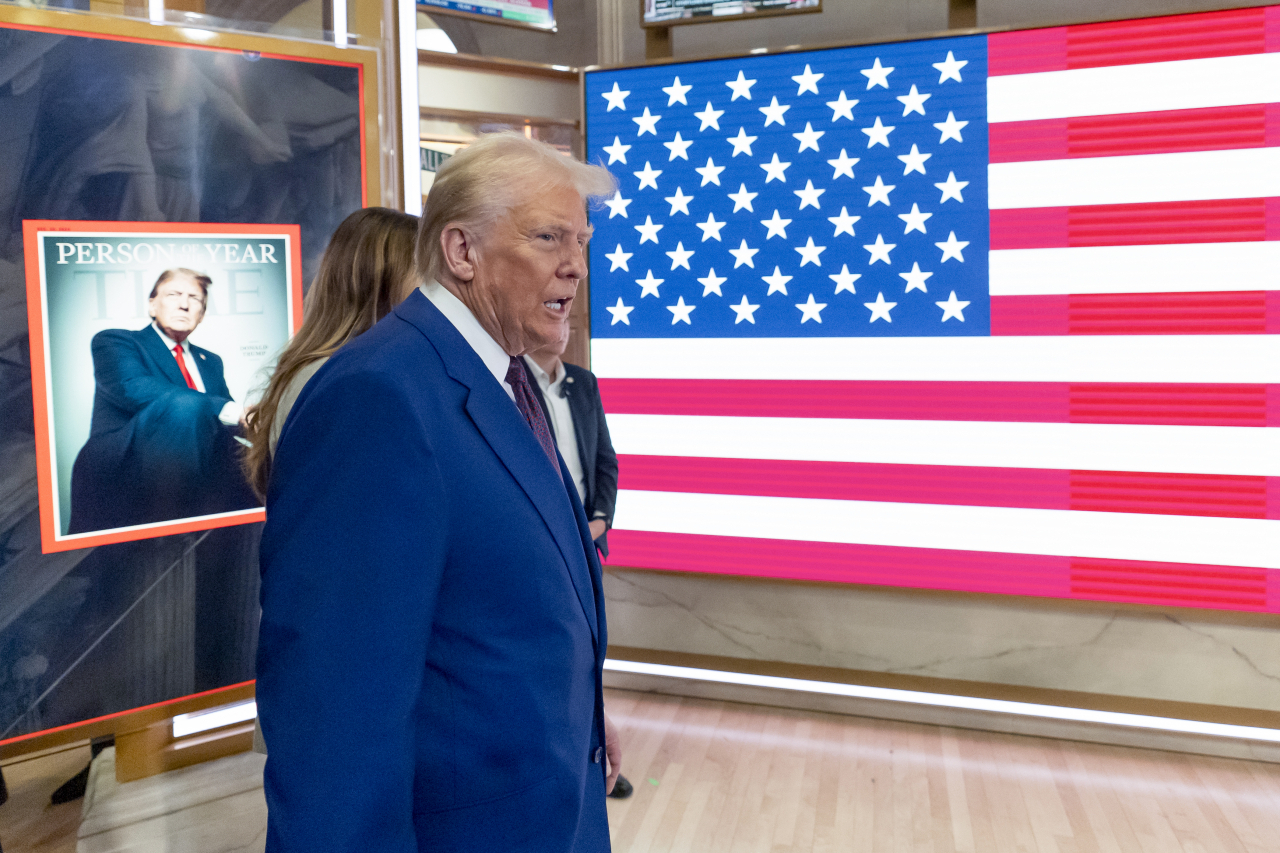

President-elect Donald Trump arrives on the floor of the New York Stock Exchange after ringing the opening bell on Thursday in New York (AP-Yonhap) |

South Korea’s parliament voted to impeach President Yoon Suk Yeol on Saturday, marking the culmination of over a week of intense political turmoil following Yoon’s botched attempt to impose martial law on Dec. 3.

While the impeachment awaits a final ruling by the Constitutional Court, observers note that the National Assembly’s decision has alleviated some of the uncertainty that clouded the market in recent weeks.

Korea’s major conglomerates are now turning their attention to preparing for broader global economic challenges, particularly navigating policy shifts expected under a second Donald Trump administration in Washington.

“The political uncertainty hasn’t completely disappeared, but companies don’t have much time, as the new US administration takes office in January,” said an industry source who requested anonymity. “Significant changes under Trump are anticipated, and the recent political turmoil has left many firms unprepared to address these potential changes in economy and trade."

The Korean economy, heavily dependent on exports, faces heightened risks, with the US being one of its largest trading partners. Key industries -- such as automotive, electronics, semiconductor and steel -- are expected to encounter challenges if Trump reinstates his “America First” policies. The changes could involve higher tariffs, renegotiation of trade deals like the Korea-US Free Trade Agreement and revisions to key Biden-era legislation, such as the Inflation Reduction Act and the CHIPS and Science Act.

Under the IRA, the US government offers tax credits for electric vehicles and batteries produced domestically or made with critical minerals sourced from the US or its free-trade partners.

In response, Hyundai Motor Group and battery firms like LG Energy Solution and Samsung SDI have aggressively invested in the US by building manufacturing facilities. However, if Trump follows through on his campaign pledge to terminate the IRA, these firms could face significant hurdles, including the loss of tax incentives, reduced demand for EVs and mounting pressure on earnings.

Another concern is the potential rollback of the CHIPS and Science Act, which incentivizes chipmakers to set up manufacturing plants in the US.

Samsung Electronics stands to receive up to $6.4 billion for its $40 billion semiconductor plant in Texas, while SK hynix is poised to gain $450 million for its $3.87 billion chip facility in Indiana. Any cuts to the CHIPS Act subsidies could force these companies to rethink their investment plans.

Victor Cha, the Korea chair at the Center for Strategic and International Studies, expressed concern over the implications of South Korea’s leadership vacuum. On a podcast hosted by CSIS on Thursday, he said people with ties to Trump have committed to policy moves affecting Korea within the "first 100 hours," not the first 100 days, of Trump's presidency, which starts on Jan. 20.

"It could have to do with (US) troops in Korea. It could have to do with tariffs. It could have to do with the CHIPS Act. It could have to do with a whole bunch of things," he said. "And there's nobody at home in Korea. There's nobody there."

In the meantime, firms are coping on their own, pressing ahead with year-end strategic meetings.

Samsung Electronics is set to hold its global strategy meeting from Tuesday to Thursday bringing together top brass from domestic and international branches. Vice Chairman Han Jong-hee, who oversees the Device Experience division — covering smartphones and consumer electronics — and Vice Chairman Jun Young-hyun, who leads the Device Solutions division — focused on semiconductors — will spearhead the discussions for their respective units.

Some major issues during the session will include the Galaxy S25 launches in January, semiconductor strategies and ways to boost global supply chains.

Hyundai Motor Group has been holding meetings since last week, with Executive Chair Chung Euisun consulting with key executives and regional office heads from major markets, including North America, Europe, India, Latin America, China and Russia.

“Conglomerates are worried that high-level talks may be delayed due to the leadership vacuum caused by the impeachment,” said another industry insider. “At a critical time when the government should be engaging in outreach efforts to advocate for Korean firms' interests in the US, companies are left to navigate these challenges on their own."

By Ahn Sung-mi (sahn@heraldcorp.com)