Finance

Mirae Asset Securities bolsters global expansion with India, Europe push

|

Mirae Asset Financial Group founder and Chairman Park Hyeon-joo (Mirae Asset Financial Group) |

Mirae Asset Securities, South Korea's largest stock brokerage company, has been achieving feats in its global expansion through its localization strategy coupled with acquisitions of financial firms in overseas markets.

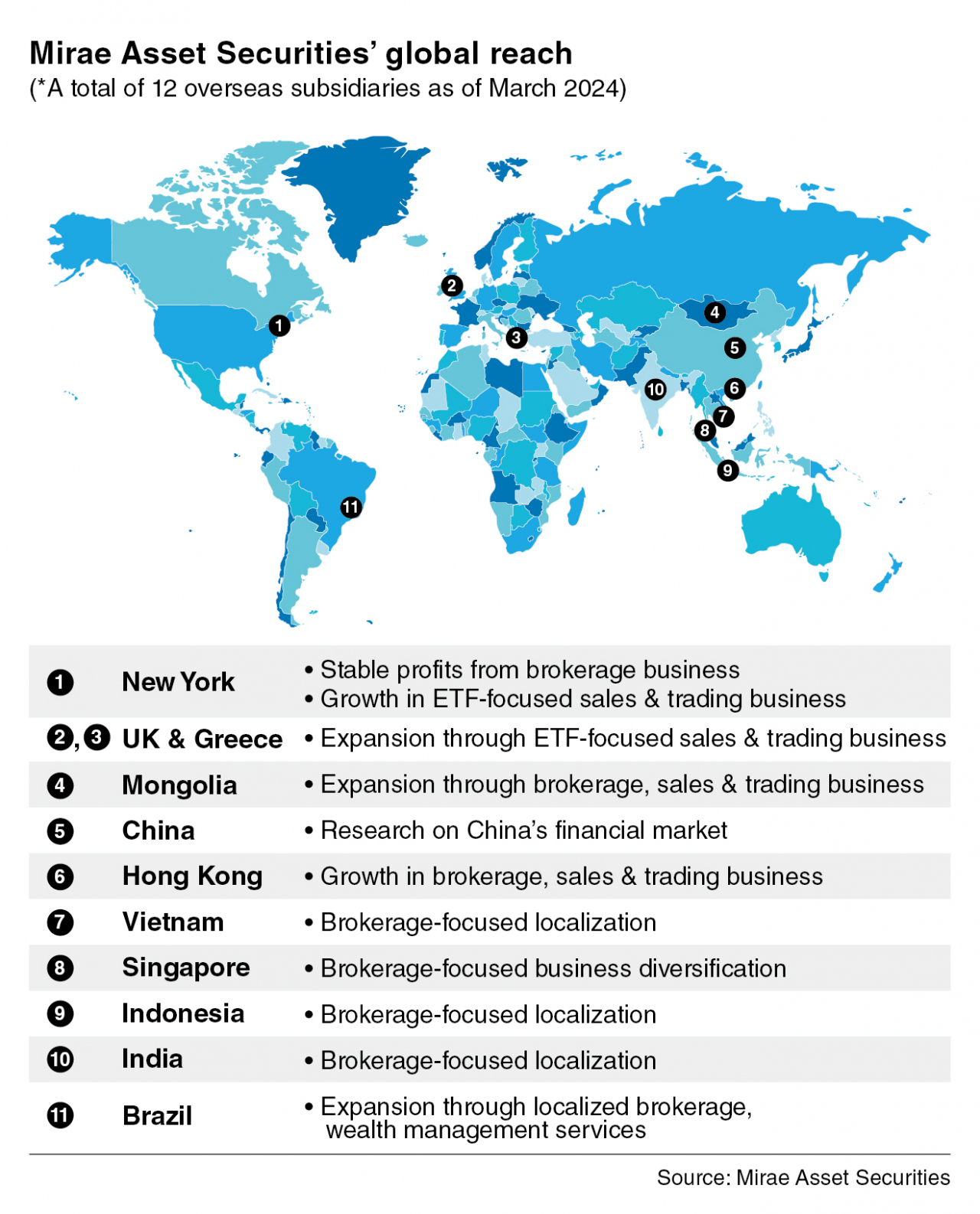

With Mirae Asset Financial Group founder and Chairman Park Hyeon-joo taking the post of global strategy officer for the group in 2018, the brokerage house has been accelerating its proactive expansion in overseas markets. It currently has a total of 12 overseas subsidiaries, spanning the US, Brazil, the UK, India, Vietnam and Indonesia.

In acknowledgment of the efforts, Park is to be honored with the International Executive of the Year Award at the annual conference of the Academy of International Business, an association of international business scholars and professionals.

The International Executive of the Year Award is given to business leaders who have led the transformation of their companies' global reputation and made new achievements. Park is to receive the award for paving the way for Mirae Asset Financial Group to evolve into a global investment bank, the firm explained.

The AIB annual conference will be held at Lotte Hotel Seoul July 2-6. Park is to deliver a keynote address at the event.

|

Mirae Asset Securities' global footprint

Customers at Mirae Asset Securities earned more than 1 trillion won ($720 million) in profits through investing in overseas stocks through the company in 2023, according to the securities firm. The accumulated income from 2020 surpasses 4.5 trillion won.

Mirae Asset Securities first ventured into markets beyond South Korea by establishing a subsidiary in Hong Kong with an equity capital of $5 million in 2004. Over the past two decades, the subsidiary’s capital has grown over $3.4 billion, marking a nearly 600-fold increase.

Recognizing the potential of India, the brokerage house has been pushing its expansion in the fast-growing economy since entering the market in 2018.

Through digital transformation efforts such as the introduction of an online retail trading platform in April 2022, its Indian business unit secured 1 million accounts in February.

It also took over local securities company Sharekhan Limited, the 10th-largest securities company in the industry, at the amount of at $370 million. Founded in 2,000, Sharekhan Limited has a total of 3,500 employees, about 3 million accounts and 130 branches in 400 regions across India.

While tapping into the Indian capital market, the firm has been making bold investments in nonfinancial companies as well.

The Mirae Asset-Naver Asia Growth Fund, a joint fund pooled by Mirae Asset Securities and Korean tech giant Naver, has recently recovered 80.7 billion won through the sale of a stake in Zomato, a leading player in India's food delivery industry. The fund’s remaining stake in the company is valued at 38.6 billion won.

This marks a 2.7-fold rise in estimated value from an initial investment of 44.6 billion won, which grew to a total of 119.3 billion won in four years.

Furthermore, the brokerage firm has been making accomplishments in Europe's capital market.

Mirae Asset Securities' London subsidiary acquired GHCO, a European finance firm in May 2023. Founded in 2005, GHCO is a market maker that provides liquidity for more than 2,500 ETF products and 19 ETF issuers, including big names such as BlackRock and Vanguard. It has its own in-house market-making system, which can cover up to 14,000 ETF products across the world.

The firm viewed that the takeover could pave the way to venturing into the European ETF market, the second-largest following that of the US, in synergy with ETF manager Global X under Mirae Asset Financial Group.

“The global business environment has been challenging with inflation and the interest rate hikes, but Mirae Asset is securing the foundation of long-term growth through overseas business expansion and investments into innovative companies,” an official from Mirae Asset Securities said.

“Mirae Asset Securities will secure the lead in its business, and continue to strive to take the leap to become a global top-tier investment bank,” the official said.

By Im Eun-byel (silverstar@heraldcorp.com)